Trending Useful Information on stock market training in chennai You Should Know

Wiki Article

Intraday trading strategy:

For novices Open High and low strategy, Range break out strategy, reversal trading strategy or some common, very simple intraday trading strategy.

Open High and Open low strategy:

When you are a beginner ideal intraday trading strategy may be 5-minute intraday trading strategy, Open = High & Open = low breakout strategy you may trade in stocks and can be done being a nifty and financial institution nifty intraday trading strategy.

If Open = low is exact in very first 5 min candle or 15 mins candle High break up aspect a trade is often taken by using a prevent loss of the Open=low with some points in buffer with a target of 1:1 or 1:2 which can transfer towards up side as it has the obtaining tension which has the probability of likely in buy path.

If Open = High is exact in initial 5 min candle or 15 mins candle low stop working facet a trade is usually taken with a quit loss of the Open=High with a few details in buffer which has a target of 1:1 or 1:2 which can shift towards down side as it has the promoting stress which has the chance of heading in down route.

Open Range Breakout strategy:

Open Range breakout strategy mark first 15- or 30-minutes candle High and low and look ahead to the breakout of upside or maybe the breakdown of draw back, which are the facet it breaks you are able to trade in that path your target will likely be 1:1 or 1:2 and a stoploss will be High of 15/30 mins candle with some buffer in the event of downside breakout and in case of upside breakout the low of 15/30 mins candle will likely be cease loss.

Both the above mentioned strategy might be traded as basic crude oil intra trading strategy but so as to trade in you must adjust your timeframe to 1 hr and you need to ignore if the candle facet is way far too major like 70,one hundred factors and if you need to trade a similar in pure gas intraday trading strategy like crude oil then you might want to use 1 hr time frame but it would be bit dangerous as you're going to be typically obtaining really big prevent reduction in organic gas.

On the other hand, trading any strategy will likely not just give You merely gains. You should accept a quit decline and abide by a process. It's also often critical to be familiar with the marketplace circumstances. Risk management Stock market courses in chennai procedure really should normally be used in order to Restrict probable losses.

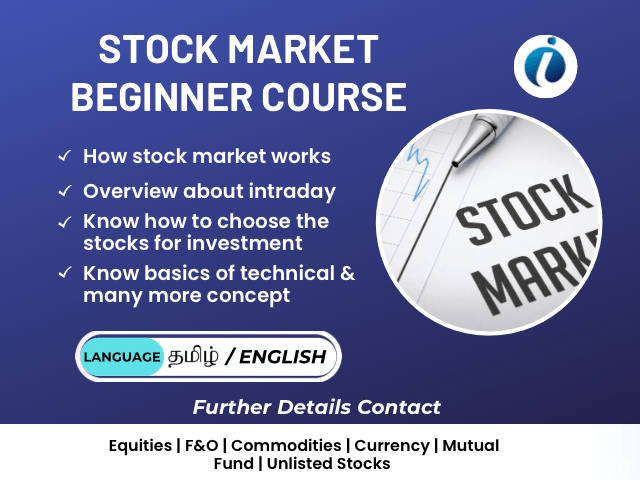

Article tags:stock market training in chennai, share market training in chennai, stock market training institute in chennai, stock market training institute near me, Stock market classes in chennai, Stock market courses in chennai, option beginner course, option strategy course, intraday strategy course, invest chennai. Report this wiki page